We Will Find a Program that Fits Your Need

Whether you are looking to fix & flip properties or hold properties for rental income, Western Capital has flexible options that are suited to your needs.

Rehab Pro

3-18 Months

Loans from $50K to $5M

Up to 90% of the Purchase Price and 100% of the rehab cost

Long Term Financing

30-Year Amortization

(ARM and Fixed rates available)

Loans from $50K to $25M

Up to 80% LTV for Purchases

Up to 75% LTV on Refinances

Short Term Bridge

9-24 Months

Loans from $50K to $25M

Up to 80% LTV for Purchases

Up to 75% LTV on Refinances

Ready to Submit Your Deal?

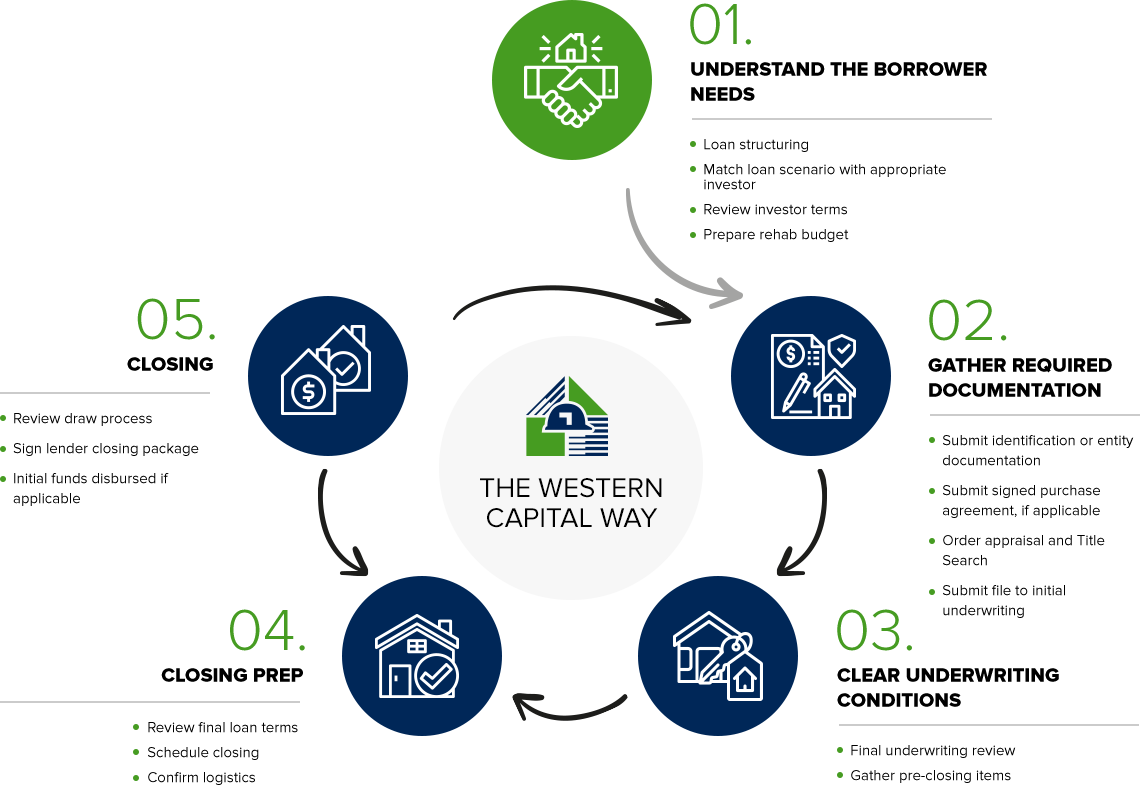

Our Process

Loan Program FAQs

Which states do you lend in?

Our portfolio of lenders cover properties nationwide, hence our programs work in all 50 states. However, some states may not allow us to offer certain types of loans due to lending restrictions set forth by that state.

What are your loan terms?

Because we work with a wide variety of investors our terms can vary depending on each borrower’s scenario. Certain factors such as credit score, property type, loan size, and borrower experience can effect you interest rate and term. Please call us at 877.451.1641 to discuss your options.

Do you have a minimum FICO score?

No. While the score is beneficial in determining the interest rate and loan terms the lenders can offer, this is not the main or sole basis for an approval. Factors such as experience and property type play a bigger role for compensating factors when dealing with a low score borrower. Please call us at 877.451.1641 to discuss your options.

Do you work with first-time investors?

Yes. While this may impact the maximum amounts an investor will be willing to lend on the deal, we have closed many loans with first-timers looking to get into real-estate as a way to build wealth outside of their primary homes.

Please call us at 877.451.1641 to discuss your options.

Do you work with foreign nationals or investors who don't live in the USA?

Yes. We do have lenders who will invest in borrowers with certain types of visas as well as green card holders. Please call us at 877.451.1641 to discuss your options.

Are the qualifications for a rehab loan different from a refinance loan?

Yes. Rehab loans are approved based on borrower experience in completing past rehab projects, and the subject property potential for future value, as determined by an after-repair value appraisal. A long term refinance loan on rent-ready property on the other hand, whether rate/term or cash out, is determined and qualified based on the established as-is value appraisal.

Please call us at 877.451.1641 to discuss your options.

Can I get a higher LTV rehab purchase loan and procure the rehab funds myself?

No. Our investors require that they furnish the rehab funds needed to complete the project and reimburse the work as it is ongoing and verified complete. Lenders expect that the borrower will have initial funds to begin the project, then submit requests for draws as the project is proven complete in phases.

Please call us at 877.451.1641 to discuss your options.

How fast can I get pre-approved?

In a couple of hours. In order to get pre-approval letter, we need a credit report, a driver’s license and our quick, one-page application. If you know the address of the subject property you want to proceed with, even better, but not required for purchase transactions.

Are there any upfront application fees or costs?

No. Western Capital does not collect application fees. The only fees the borrower will be responsible for will be appraisal fees paid directly to the appraisal company and a credit report fee which some lenders may collect once the terms are accepted by all parties and the loan is ready for initial underwriting. Some lenders may collect the credit fees at the closing.

What type of documentation is required for the loan application?

We need the borrowers credit report, copy of the driver’s license and the loan application that we can help you fill out.

All the lenders we work with will require a title insurance, search and commitment and an appraisal once the loan is determined to be moving forward and all terms are agreed upon.