With its higher LTV ratio, our Rehab Pro loan is designed for investors seeking an interest-only, short-term financing option for rehab projects.

Key Features

- A higher LTV than hard money options.

- Great for borrowers who need a quick close.

- An interest-only 12-24 month term provides lower monthly payments.

- Perfect for acquiring or leveraging real estate that is already owned.

- Allows borrowers to finance improvement costs.

- Great for Foreign investors residing outside of the USA.

Property Types

- Investor 1-4 (SFR, Condo, and 2-4 Units)

- Multi-Family (5+ Units)

- Mixed-Use

- New Construction (Ground up or Tear Down)

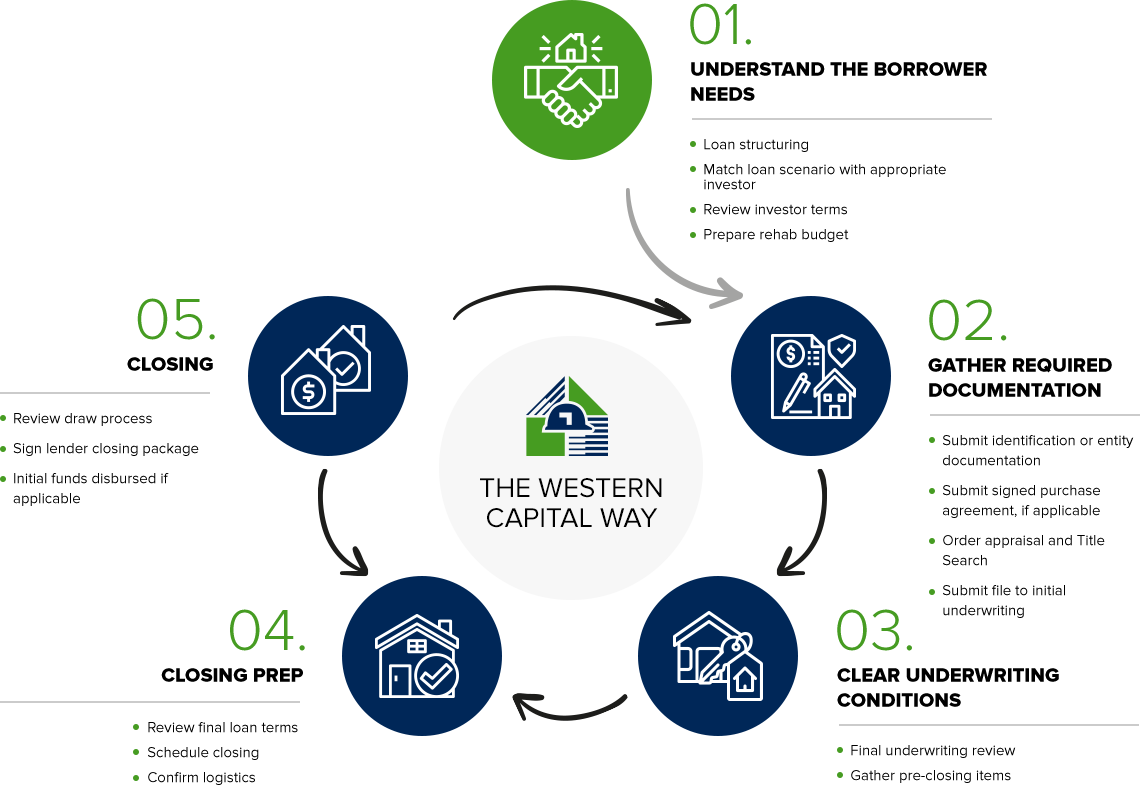

Our Process

Loan Highlights

Ready to Submit Your Deal?

Rehab Pro FAQs

How many draws can I take once the loan closes?

There is no limit. However, we recommend our Borrowers keep the number of draws to 4 or less, as there is typically a draw inspection fee charged by the Lender each time.

How do you determine the loan amount for the Rehab Pro program?

The loan amount is determined on 2 parts of the appraisal, the As-Is value and the After-Repair Value (ARV). Most lenders will fund all of your Rehab budget along with a percentage of your purchase price or As-Is Value, but will not exceed 70% of the ARV.

How do I receive my Rehab funds once the loan closes?

Rehab funds are released as a reimbursement once the Lender confirms that the work has been completed in your project. Amounts are based on what you detailed in your rehab budget provided to the Lender at the beginning of your loan application.

How do you determine the loan amount for the Rehab Pro program?

The loan amount is determined on 2 parts of the appraisal, the As-Is value and the After-Repair Value (ARV). Most lenders will fund all of your Rehab budget along with a percentage of your purchase price or As-Is Value, but will not exceed 70% of the ARV.

Which Rehab terms are different?

Terms vary greatly depending on Borrower experience with completed rehab projects in the last 3-5 years and credit score.

What paperwork do you need to get a Rehab loan started?

You will need a purchase contract for a purchase, as well as a rehab budget and a loan application. You can find some templates in the Resources section of our website.